Terry Slavin reports on the leaders and laggards in CDP's first investor research report on the fast-moving consumer goods sector

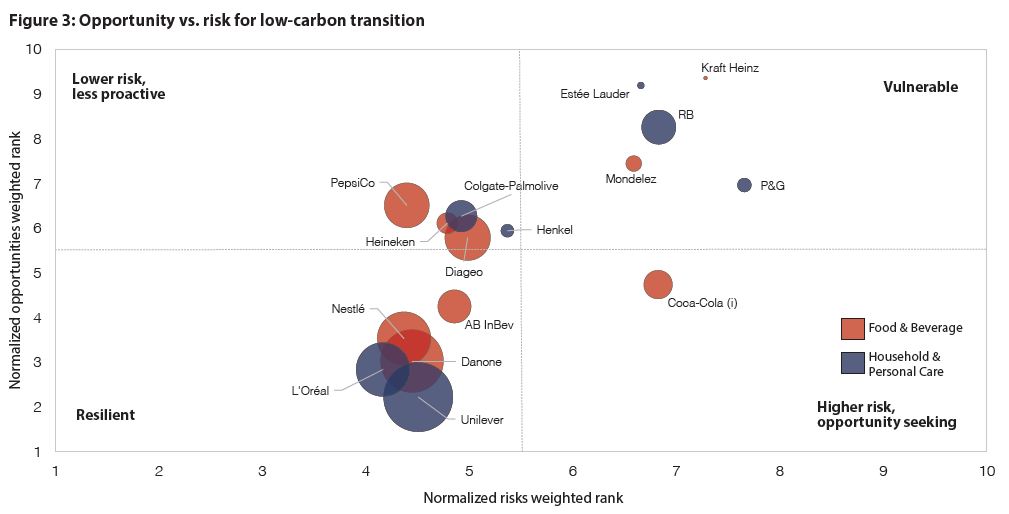

Danone comes out tops among multinational food and beverage companies in its preparedness for the low-carbon transition, according to CDP’s first investor research report on climate risk in the consumer sector. Second and third place go to Nestlé and AB InBev.

Among major household and personal care companies, Unilever tops the climate risk leader board, followed closely by L’Oréal.

Kraft Heinz and Estée Lauder, meanwhile, are the biggest climate laggards among the 16 fast-moving consumer goods companies (FMCGs) assessed in CDP’s report Fast Moving Consumers.

CDP pointed out that FMCGs are responsible for over a third of global greenhouse gas emissions. Unlike many other sectors, 90% of their carbon emissions lie in the value chain, leaving companies exposed to both raw material risks and to changes in consumer preferences.

Buying niche environmental brands is not sustainable if business models based on more consumption remain unchanged'

Importantly, they also have the opportunity to drive behaviour change among consumers to more climate-friendly choices.

CDP says consumer companies are investing in transformative innovation, particularly in the development of alternatives to plastic packaging and in plant-based alternatives in food and personal care products. But the report adds that innovation is not being applied to their biggest-selling products.

“Almost 60% of the top 10 revenue-generating brands for each company have failed to deliver low carbon innovations in the last 10 years. Given most companies (88%) generate over 50% of their revenues from these key brands, including Nescafé, Budweiser and Dove, they must up their game or risk falling foul of changing consumer demands.”

It also notes that R&D expenditure is low, but merger and acquisition spending is high as FMCGs increasingly buy niche, environmental brands, such as Nestlé’s recent acquisition of Sweet Earth and PepsiCo’s purchase of Bare Foods. But the report warns that “this approach will not be sustainable if their fundamental business models, which are based on driving more consumption, remain unchanged”.

The report points to impending regulation that threatens the sector, including more robust rules on packaging and waste from the EU, and the proposed introduction of labelling and carbon footprinting.

“The sector is also highly exposed to the physical risks associated with climate change. For example, heat stress and water scarcity have the potential to disrupt agricultural supply chains and cause price volatility,” CDP says.

Personal care and home care companies are most exposed, due to the amount of water it takes to use their products

“This poses a real threat to the sector, especially for diversified food companies like Nestlé and Kraft Heinz, which rely on a variety of raw materials. When it comes to physical risks in the consumption phase, personal care and home care companies are most exposed, due to the amount of water it takes to use their products.”

The report points out the deforestation risk posed by palm oil, pointing out that companies have been slow to respond to intense media scrutiny in the last year, with less than 45% of palm oil bought by personal care companies coming from physically certified sources, and only Danone and L'Oréal sourcing 100% of their palm oil in this way.

Carole Ferguson, head of investor research at CDP, said: “As consumer-facing brands, at risk not just from climate change but water scarcity and deforestation too, these companies have a unique role to play in driving forward the sustainable economic transition. Ongoing activism around plastics and packaging is just the tip of the iceberg, and we expect to see more environmental issues come to the fore as consumers start to question what goes into the products they buy, use and dispose of.”

She added that the efforts of leading companies “need to be replicated by others in the sector, if they are to justify their role in a society that can no longer be based on fast paced, rising consumption and linear business models”.

This article is part of the in-depth briefing Stepping up to 1.5C. See also:

Why even Republicans are backing a Green New Deal for America

Can UK Acorn carbon capture project grow into solution to industry emissions?

Drax targets negative emissions with world’s first biomass CCS project

From cookstoves to carbon markets: how blockchain is supercharging sustainability

‘We’re rethinking our entire business, from supplier agreements to future technologies’

‘Divestment isn’t a badge of honour; it’s a failure of engagement’

‘If companies want to meet climate targets, they have to take employees on the journey’

‘We can only achieve a 1.5C world if science and business work together’

ethical investing water risk resilience FMcGs Danone Kraft Heinz CDP AB InBev plastic packaging Estée Lauder