Angeli Mehta reports on how technology is revolutionising agriculture as Silicon Valley comes to the farm gate

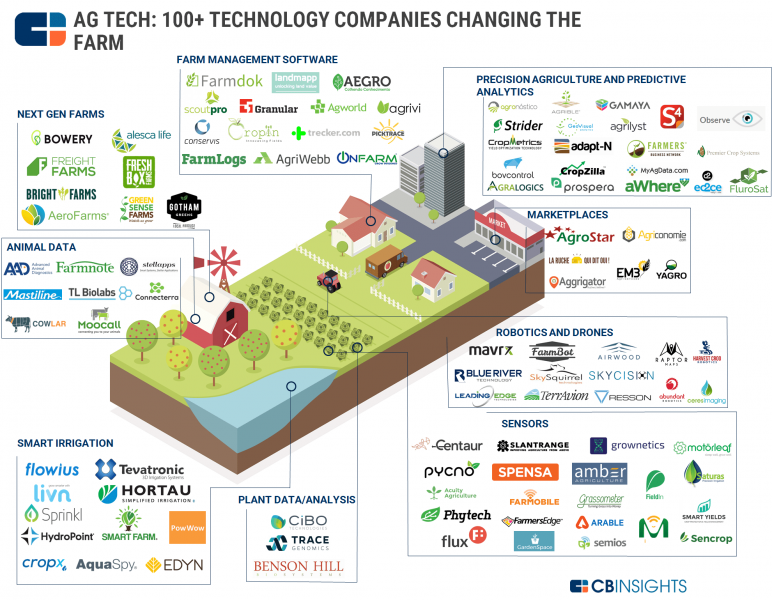

Data is shaping almost every area of our lives. Agriculture has been slow to embrace new technology but even here it’s beginning to have a big impact. There are now hundreds of companies offering everything from farm management and precision tools to bots and drones. Some tractors have computing power that would have turned Nasa’s moon-landing mission green with envy.

What started in farm equipment is moving into the field – at least in the developed world. More and more data is available as farmers use sensors for soil sampling and mobile apps, cameras and drones to monitor pests and diseases. Data science teams are using satellite imagery married with historical records to predict crop yields around the world. A bounty of data for machine learning and image recognition has been supported by continual advances in computing power.

“I’ve lived Moore’s law and that’s happening here,” remarks Dave Stangis, who spent 11 years at chip-maker Intel before moving to Campbell Soup Company.

It was Intel’s co-founder Gordon Moore who, in 1965, predicted a doubling of computer processing power every two years.

It was Intel’s co-founder Gordon Moore who, in 1965, predicted a doubling of computer processing power every two years.

To be more productive, farmers need technology to help them make timely decisions. “It’s easy to forget that farmers get one, maybe two chances a year to get it right,” says Diane Holdorf, chief sustainability officer at food manufacturer Kellogg. Indeed their livelihoods depend on it.

Investment in technology is big business. According to AgFunder, an equity crowd-funding platform, agri-tech start-ups raised $4.4bn globally in the first half of last year; 21% of that in Europe. Among them Lille-based Sencrop, whose rain and wind gauges keep track of temperature, humidity, rainfall and wind in the fields. Overlaid with current and historical climate data, its systems allow farmers to make decisions about irrigation and seeding – even anticipating disease, all from their smart phones.

One of the biggest deals in recent years was Monsanto’s acquisition of The Climate Corporation. This California-based firm started out selling insurance against extreme weather events, and not surprisingly farmers were among its customers. Now it gathers data from sensors and satellites to analyse soil organic matter and nutrients, and monitor crop yields and local weather patterns, to help farmers get the best out of the soil, water, fertilisers, pesticides, and seeds they use.

Silicon Valley has moved to the Midwest and is at the farm gate

As its chief science officer Sam Eathington put it in a company blog last month: “Silicon Valley has moved to the Midwest and is at the farm gate.”

Monsanto, itself a pioneer in biotechnology, is moving rapidly into data sciences.Chief executive Robert Fraley sees advances in both driving the “sustainable intensification” of agriculture around the world, getting more out of existing agricultural land and improving the environment.

The Climate Corporation has plenty of competition. Tractor giant John Deere, cooperative network Land O’Lakes and seed producer DuPont Pioneer all offer equipment, software tools and services for field management. The Sustain platform – originally developed by United Suppliers and the Environmental Defence Fund – has a suite of “precision conservation tools” to improve soil health and better manage water and nutrients.

Data monitoring on the farm enables them to show retailers, and in turn consumers, what has been achieved. Farmers who grow crops for Campbell Soup and Kellogg, for example, are involved in the programme.

John Deere’s equipment can precisely control seeding densities, determined by detailed data on conditions across a field. Crop yields can be measured as grain flows into a harvester and in conjunction with GPS data, used to map productivity in minute detail.

See & Spray uses similar algorithms to those in facial recognition software to distinguish weed from crop

Last autumn, the tractor firm bought a California start-up that uses machine vision and artificial intelligence (AI) to detect weeds and deliver a targeted dose of herbicide to each weed. Blue River Technology’s See & Spray system of cameras and computers is towed behind a tractor and cuts herbicide use by around 90%, compared with spraying a whole field.

The company’s first machine was a lettuce bot, now being used by growers to weed and thin young lettuce plants.

See & Spray uses similar algorithms to those in facial recognition software, and is “trained” on tens of thousands of images to distinguish weed from crop. It makes 5,000 decisions each minute, and has an accuracy to within 63mm, according to business development director Ben Chostner.

The Gulf of Mexico ‘dead zone’. (Credit: Jeff Schmaltz/NASA Earth Observatory)

He told a conference audience last year that the data collected while spraying produces mapping for every field so farmers can compare weed pressures over time, and in different parts of a field.

A week later a drone surveys the field to check the weeds have been removed. That learning goes back into the system. Blue River Technology is also working on soybeans, chickpeas, corn and peppers, and anticipates farmers being able to use it to spray fungicides and fertiliser as required across a field.

You have to be part of a community of farmers to afford access to the data ... how can that be made available at a small-scale?

Means to cut fertilisers use are urgently needed. In the UK, farming is the most significant source of water pollution and of ammonia emissions into the air, both of which harm ecosystems. The picture is similar in the US and China. The bulk of nitrogen and phosphorous in fertilisers doesn’t get taken up by plants, but makes its way to the sea, where it disrupts ecosystems by triggering algal blooms. These choke off oxygen, killing marine life. One of the largest of the world’s “dead zones” is in the Gulf of Mexico where almost half of US seafood is caught.

The precision application of fertilisers and pesticides is transformational, observes Holdorf, of Kellogg. The caveat, she adds, is that “you have to be a community of farmers to co-invest to access the data today. The question is how does that data get to be made available at a small-scale level?”

The myriad of systems available now are all measuring slightly different things, and don’t yet talk to one another. The OpenAg Data Alliance is working towards open standards software, which would help give farmers all the information they need. After all, information is power.

‘Moore’s law is happening here’ – David Stangis of Campbell Soup

Stangis, at Campbell Soup, thinks there will be consolidation in the industry and that there will be a platform around analytics, like a Facebook or Amazon.

Alexandra Brand, chief sustainability officer at agrichemicals and seed producer Syngenta, suggests cheaper drones will be a huge driver of productivity for the small farmer. A drone taking pictures of the condition of plants and field will help farmers determine if the soil is dry or whether insect pests are gathering.

Syngenta’s data efforts are further forward in the US than anywhere else. It collects data from farmers including tilling, soil condition, water use, and fertilisers. When aggregated intelligently, the data provides feedback on sustainability – for example how much carbon is being sequestered.

It is working with the AI for Good Foundation on food security. One project is using algorithms to predict how seeds will behave in different soil types. “A seed is like a child,” says Brand. “The soil is the environment in which it starts its life.” If the soil is too hard the roots can’t penetrate; if it’s acidic the seed will need protection.

Scientists are working on understanding how gut microbes and selective breeding might cut methane emissions from cattle

While Campbell Soup doesn’t own any farms, it is investing in metrics and considering what data to collect from growers. One example is tomatoes. It’s starting to collect analytics from its growers around fruit quality (as determined by solids and sugars) and water use. Every trailer is sampled and, based on quality, they’re called into the plant. All the data is analysed and shared back so an individual farmer can see how he compares and what improvements he could make. More of its farmers are converting to drip irrigation, which works underground to release water at the crop roots. “We’ve seen some great improvements across the board and water use has gone down,” says Stangis.

Facial recognition software for cattle and pigs sounds like science fiction, but it could transform livestock health monitoring, whether it’s keeping an eye on animals about to give birth or spotting early signs of ill health. Irish firm Cainthus has developed a system that can identify cows that are not eating, or are behaving aggressively.

German-based Evonik Nutrition & Care is working on proof of concept with a large US poultry producer to demonstrate on the farm what has been possible in its laboratory simulations of a chicken’s gut. The aim is to cut antibiotic use, saving them only for when disease is real. Scientists at SRUC in Scotland, meanwhile, are working on understanding how gut microbes and selective breeding might cut methane emissions from belching cattle.

Facial recognition software for livestock could transform monitoring. (Credit: Mahey/Shutterstock)

The massive dairy herds maintained in Saudi Arabia are all micro-chipped and data is regularly sampled to try to identify health issues before symptoms actually occur. Robots are appearing in US dairy farms, and improving milk yields.

Besides potentially freeing farm workers from some of the most back-breaking work, there are economic and political drivers. The availability of migrant labour in the UK is in question through Brexit and there are labour shortages in California thanks to a clampdown on undocumented migrants who pick the state’s soft fruit and lettuces. On the other side of the globe, China is striving for self-sufficiency in food production while in Japan a lack of inward migration and an ageing population are pushing innovation forward.

Simon Pearson, director of the Lincoln Institute of Agri-food Technology, believes robotics technology is still developing. “We’re two to three years off really effective robotic harvesting anywhere in the world,” he says. Backed by Innovate UK funding, his team built a broccoli-harvesting system, which it trained to distinguish between weeds and plant; head and leaves.

Consumers could help drive that revolution with a better understanding of where their food comes from

A follow-on project produced a robot prototype that was successfully tested last year. He argues robotics alone will not be the solution: genetics will be needed to identify traits that make a broccoli head better designed for cropping. Tomatoes and mushrooms could be feasible, but fruit is a far tougher challenge. The proof of concept, he says, is done but processing needs to be faster. “There are a heap of challenges to go from 30 seconds [each fruit] to two.”

The Hands Free Hectare project, led by UK-based Precision Decisions and Harper Adams University, successfully grew barley from seed to harvest without a human in the field. Moreover, the team used only off-the-shelf technology and open source software. Now it’s trying to improve the accuracy of the machinery to get a better yield this year, with winter wheat, and has been exploring applications in India.

If big data can make farming more sustainable, consumers could help drive that revolution with a better understanding of where their food comes from. The key to unlocking that challenge may lie with blockchain, most often associated with cryptocurrencies like bitcoin. It’s essentially a means to digitally store and share information about every link in a chain in real time, and the information is kept in perpetuity.

“Blockchain enables data verification through consensus and provenance. By using blockchain, organisations and individuals can attain greater confidence in data on the ledger because consensus of all parties is required for that data to be added, and provenance ensures that the existence of data can be traced back to its source,” according to Don Thibeau, offering manager for IBM Blockchain.

China is striving for self-sufficiency in food production, but consumers have become concerned about the provenance of food

Last August, IBM announced a collaboration with a group of food suppliers, including Walmart, Unilever and Nestlé, with the aim of strengthening consumer confidence in the global supply chain. Walmart ran two pilots, one with mango, to see how long it would take to trace back through the supply chain to find the farm where the mango originated. Without blockchain, the exercise took almost a week. Using blockchain, it took about two seconds.

Such speed will transform the detection of the source in an outbreak of food poisoning, but Walmart’s vice-president for food safety, Frank Yiannas, says a big driver is transparency. Consumers will be able to discover immediately how an item of food is produced, and whether it is sustainably grown.

Walmart and IBM followed up in December with an announcement that they’d work with Beijing’s Tsinghua University on food tracking, traceability and safety in China. The Chinese government is striving for self-sufficiency in food production, but consumers have become concerned about the provenance and safety of food. Although clearly, China doesn’t have a monopoly on food scandals.

Sepehr Mousavi, sustainability strategist at Sweden’s vertical farming pioneer Plantagon wants to build a blockchain model that shows a consumer nutritional information, and precisely how far a product has travelled. He hopes consumers will be able to scan one of Plantagon’s leafy greens to discover who harvested it, and how old it is.

Holdorf of Kellogg suggests it’s still early days in terms of how blockchain is being applied to track fresh fruit and vegetables, where there is “a clear line of sight” from field to store. But she ponders that it might also provide a tool for increasing the transparency of grains, where a grain store takes the input of many farms. And it works the other way too: “A lot of farmers like to know how their crop connects to food.”

Kellogg has made some big commitments to responsibly sourcing 10 priority ingredients by 2020, and to support climate smart agriculture. With blockchain, its customers may just be able to hold it to account.

This article is part of our in-depth briefing on Future of Farming. See also:

From vertical farms to new proteins: innovating to feed the planet

A sea change in the way we farm fish

Can agri-tech sow a green revolution for India’s poorest farmers?

Applying AI to the humble potato

Main picture credit: Ivan River/Shutterstock, Inc

agri-tech precision farming Syngenta Kellogg's Walmart Plantagon IBM Blockchain Lincoln Institute of Agri-food Technology Hands Free Hectare Evonik Nutrition & Care AI for Good Foundation OpenAg Data Alliance Campbell Soup AgFunder Sencorp John Deere Blue River Technology Monsanto The Climate Corporation Sustain