The Boston Consulting Group’s Douglas Beal explains the consultancy’s research showing that companies that put ‘doing good’ at the heart of business strategy outperform their peers

Corporations and investors have long sought to demonstrate a relationship between higher company profits and valuations and the degree to which companies use their assets and know-how to improve society.

Many academic studies have shown this. But the findings typically have not been specific enough to help CEOs plan a course of action. Recent research by The Boston Consulting Group fills this gap by examining the relationship between financial performance and corporate involvement in environmental, social and governance (ESG) matters, both on an industry-specific basis, and by breaking it down by ESG topic.

We looked at five industries: banking, biopharmaceuticals, consumer-packaged goods, oil and gas, and technology. In every case, the data indicated that companies that integrate societal impact concerns into their business strategies, organisations, and day-to-day operations generally enjoyed both higher earnings, as reflected in margins, and higher share values, as reflected in valuation multiples — together good proxies for total shareholder return, or TSR — than peer companies placing less emphasis on such matters.

Though we were unable to analyse the relationship between ESG performance and financial performance in the technology sector, due to data challenges, the differences in the other four sectors were significant. For example, in the consumer-packaged goods sector — mostly food and beverage companies — we calculated a valuation premium of as much as 11% among companies with the greatest focus on such ESG matters as product safety, water conservation, and reducing excess packaging.

For top performers in the biopharmaceutical industry, where ESG concerns are different (but no less important) the valuation premium was 12%. In the oil and gas sector we found a difference of 19%. And in banking it was 3%. Earnings were higher, as well, among the companies with standout ESG performances.

Of course, it’s important to understand that companies may benefit society in many ways. There is no set formula for measuring this. For the pharmaceuticals industry benefitting society is its primary business; in other cases, the link is less obvious.

To gauge this, we looked at what we call the “total societal impact” (TSI) of each business: that is, the total benefit to society attributable both to its products and services and to its operations and activities, including charity.

Companies in all of the five industries we examined are using their knowledge, skills, and resources to solve some of the world’s most pressing challenges. Some of the matters they’ve been addressing are common to virtually all companies in all industries, such as supporting diversity and reducing the environmental impact of company operations. Others are unique to the companies in a single industry, such as expanding credit availability to underserved communities and expanding internet access.

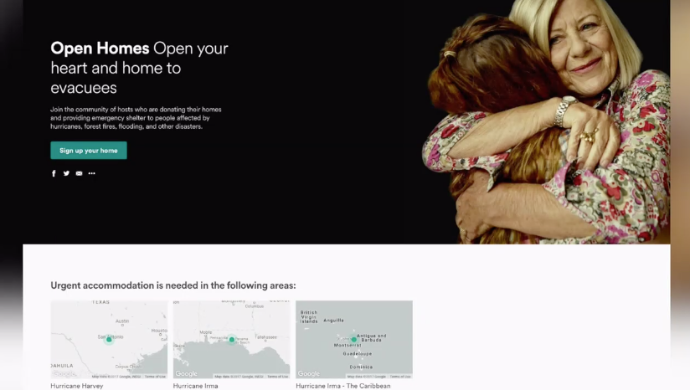

Airbnb, DHL and Walmart, for example, have leveraged their core strengths to become leaders in disaster-relief. Airbnb early this year made a pledge to arrange short-term housing for 100,000 refugees, disaster survivors, and relief workers over the next five years. We found that these efforts not only are providing concrete social benefits, but are helping to grow the business, since nearly 50% of the hosts who joined Airbnb following 2017 disasters (such as Hurricane Irma in Florida) were previously unregistered with the company.

DHL, meanwhile, has created a series of disaster-response teams, using its expertise in logistics to move supplies where they’re needed in the aftermath of natural disasters. After the severe tropical Cyclone Winston hit Fiji in 2016, for example, DHL organised the logistical handling of all relief supplies coming into Walu Bay and Nausori Airport, and was able to provide NGO officials and Fiji’s National Disaster Management Office with an accurate picture of the available aid and where it was located. Walmarthas been playing a similar role, drawing on its logistics expertise to deliver disaster relief not only to US communities hit by forest fires, hurricanes and tornadoes, but internationally as well, from Nepal to the United Kingdom.

Not all ESG efforts are as clearly visible as disaster relief. Unilever has been focusing on the environmental challenge of reducing packaging waste. Since 2010, the company has reduced its “waste footprint” by 28%, saving millions of euros in packaging costs annually. By 2025, it is committed to making all its plastic packaging reusable, recyclable or compostable.

PepsiCo’s Sustainable Farming Initiative is another example. The programme is helping growers around the world increase yields, protect the environment, better manage costs and improve the working conditions of workers. This is good for the growers as well as the company, strengthening its global supply chain. PepsiCo expects the initiative to cover more than 7 million acres by 2025, representing three-quarters of its annual agricultural spending.

Another company that stood out is Merck, the pharmaceutical giant. A programme started in 2010 has the goal of making Merck products accessible to 80% of the world’s population. In pursuit of this goal, the company has reduced manufacturing costs, made changes in packaging, distribution and storage, and has taken other steps that have helped both the company and those who benefit from its products.

I could go on: Mastercard. Microsoft. Standard Bank of South Africa. Our research has shown that they, and many other companies, are proving through their actions that doing good and doing well not only are compatible, but symbiotic.

Four things CEOs can do

The effort to make meaningful contributions to society must start at the top, and there are four key things that the CEO can do to help improve TSI and TSR.

First, they should envision what the company’s societal impact should be. In particular, they need to look into the future to gain insight on how the company should evolve to be in step with changing societal expectations and regulations.

Second, CEOs should communicate that aspiration and goals to shareholders and other stakeholders. This can help to renew and strengthen the sense of the purpose in the organisation, as well as the meaning of the brand and legacy of the CEO.

Third, the CEO needs to assess the company’s current TSI, which requires a review of the economic and social benefits of everything the company does.

Finally, the CEO much turn vision into action by integrating TSI concepts into strategy-setting and the business model.

TSI cannot be the sole responsibility of one team in the organisation. It must be elevated alongside the goal of creating value for shareholders and become an essential part of the senior team’s agenda in order for the TSI mindset to become embedded in corporate thinking and operations.

Douglas Beal, based in Hong Kong, is a director of The Boston Consulting Group’s social impact practice and co-author, with several others, of the recent BCG report, Total Societal Impact: A New Lens for Strategy.